Surge Credit Card is a product of Continental Finance. Moreover, SurgeCardInfo has a whopping 2.6 million customers around the globe. To login on a SurgeCardInfo or Surge Mastercard login is a piece of cake, we’ll show you how easy it is.

or

According to my, the Continental Finance Surge Credit Card is a unique credit card designed for people with bad credit who wish to improve their credit score. Moreover, this SurgeCardInfo offers numerous convenient features that contribute to this.

Paying bills online, updating contact information, and reviewing your monthly statement history is conveniently accessible through your SurgeCardInfo online account. The guide we have created on this page will help you understand not only how to sign in to your Surge Card Info online account, but also how to SurgeCardInfo Activate Card your newly received credit card.

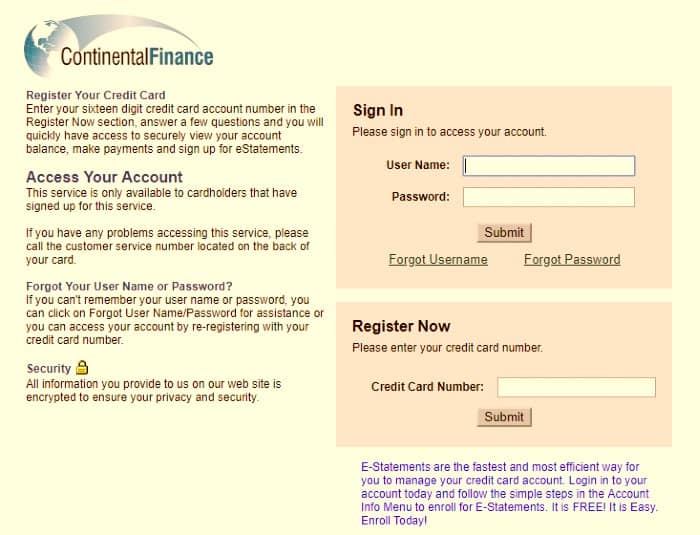

Online account registration is available at SurgeCardInfo.com, as well as access to an existing account.

Process To Register Your SurgeCardInfo

After Activation now let’s move on to one of the most important steps, which is the Surge Card Info registration procedure at www.surgecardinfo.com. Furthermore, registration is the only way to obtain the login information for your SurgeCardInfo.com Login. Also, registration of your Surge credit card is required in order to use all online services. So, let’s follow the below-given instructions step by step:

- To initiate the process first move to yourcreditcardinfo.com on your PC or laptop.

- On the right bottom, you will see a “Register Now” button. When you click that button, you will be taken to a new window.

- When you click the “Register Now” button, a registration window will open. Some credentials will be required for the verification of your identity.

- A 5-digit zip code, the last four digits of your credit card, and the last four digits of your SSN (Social Security Number) will be needed to complete your payment. After entering these credentials correctly, simply select the “Lookup Account” button.

- When you click the Lookup Account button, you will be taken to another page. To obtain the SurgeCardInfo Login information, please enter all of the required information in the appropriate fields and click the Register button.

That’s it! Your account has been registered successfully and is ready for SurgeCardInfo Login.

Complete Login Process Of Surge Mastercard

Continental Finance offers the SurgeCardInfo.com Login. Over 2.6 million customers trust Surge credit cards worldwide. Since so many people have trusted this card around the world, all the processes like activation, logging in, etc are made customer-friendly, which means they are made super easy to follow. Just follow the given below steps carefully.

Usage of Surge credit card in places like, on a tour or shopping or it can be any other payment, is the best option you can have. The best part of using a Surge credit card is how easily it can be used to make smooth payments. The simple steps for logging in to your Surge credit card are as follows:

- To initiate the process first, navigate to the Surge Card Info official website, https://www.surgecardinfo.com/.

- Select “Login” from the drop-down menu.

- There you will be asked to enter your “Username” and “Password.” Please fill in the credentials carefully.

- When you press the button after completing, you will be logged in.

Which Are The Most Important Functions?

The initial credit limit is between $300 and $1,000:

A Mastercard SurgeCardInfo with a credit limit of $300 to $1,000. Use your SurgeCardInfo wherever Mastercard is accepted. You can shop, eat out and even go on vacation with your new Surge credit card. Your Surge credit card account can help you improve your credit score by making your payments on time and keeping your balance within your credit limit.

Monthly report to the three major credit bureaus:

Credit card surge is a useful tool to increase credit. Continental Finance welcomes customers with less-than-perfect credit who apply for a SurgeCardInfo Login. Continental Finance reports its transactions to TransUnion, Experian, and Equifax, mainly three credit bureaus.

Your credit limit may increase after just 6 months:

After just 6 months, you will be able to qualify for the first credit limit increase. Increasing your credit limit is a big step in the right direction if your goal is to increase credit. Depending on your income and insurance, a Continental representative will review your account and decide if you can increase your credit limit. You can benefit from greater purchasing power, lower loan utilization rates, and the opportunity to improve your credit score.

Free credit reviews every month:

You must create an account to SurgeCardInfo Activate Card a Surge Mastercard. When you sign up for electronic bank statements, one of the best things about this account is that you get free monthly credit. Your score is available once every month. You can see the impact on your credit score from actions like making your monthly mortgage payment each month when you make or repair a loan for the first time.

Benefit from Mastercard’s Zero Liability Fraud Policy:

If you are responsible for Mastercard fraud, you will not be responsible for illegal charges to your Surge credit card. You are solely responsible for the transactions you make with Mastercard Zero Fraud Liability so that you can make purchases in comfort, knowing that your card activities are completely safe. Continental Finance protects your SurgeCardInfo account, whether you’re shopping at a store, traveling abroad, or transacting online. Mastercard’s policies apply zero liability for Mastercard fraud.

| Official Name | SurgeCardInfo |

|---|---|

| Portal Type | Login |

| Services | Credit Management |

| Managed By | Continental Finance |

| Country | USA |

Surge Card Info Online Account Requirements

An Electronic Device

To do this, SurgeCardInfo, each user must have an electronic device that can access the Internet. The device can be a laptop, PC, or cell phone. Each device has its own strengths and weaknesses. Therefore, it depends entirely on the users’ choice. The employee can appropriately choose and access their SurgeCardInfo account with the device of their preference.

Good And Secure Internet Connection

Some personal information should be provided by the user. Therefore, it is recommended that you use a secure Internet connection when logging into your registered account. A good internet speed will also help you to finish this faster than without delay.

Valid Email Address

A valid email address is the last thing you need to prepare before starting. Your email address will be required during the SurgeCardInfo Login process. You don’t have to worry because your email will not be shared with anyone else. In fact, you will receive important information through your email.

How Can I Restore Credentials?

No wonder most of us easily forget our passwords. Besides, it’s something natural. However, there is nothing to worry about. Credit card overcharging is a very convenient way to retrieve your login credentials. Here are the most important steps to take to recover your username or password:

- Go to yourcreditcardinfo.com website

- Below the login button, you will see the “I forgot my username or password” button on this page.

- Click the Forgot Username or Password button and a new page will open. This will ask for your card and account information for verification.

- After verification, you will recover your login data in a few seconds.

Know About Prices And Fees

The SurgeCardInfo has an annual fee of $75 to $99, which is pretty high for a build credit card. There is also a potential monthly maintenance fee of up to $10. Other credit cards do not charge monthly maintenance fees.

There is also a one-time surcharge of $30 per card, if applicable. The card has a cash advance fee of 5% of the cash advance amount or $5, whichever is greater. For trips abroad, a transaction fee of 3% abroad is charged. Late payments and refunds are subject to penalties of up to $40.

Annual percentages vary between 24.99% and 29.99%, depending on credit quality. It’s quite high compared to other credit cards. High annual percentage rates are typical of credit cards.

Frequently Asked Questions

Does the Surge credit card increase credit lines?

Once your Surge credit card is approved and you have used it responsibly for six months, you may be eligible for a credit increase.

Is the Surge credit card a secure credit card?

The emergency credit card is an unsecured credit card, which means that you do not need to make a cash deposit as a guarantee.

Are there any fees associated with the Surge Credit Card?

The annual fee for the SurgeCardInfo Login credit card is $75-$99. There may also be a monthly maintenance fee of up to $10 (after the first 12 months of opening an account).

Which bank has a credit card with a surcharge?

Celtic Bank Surge Mastercards were designed for customers with bad or limited credit histories. The three major credit reporting agencies receive information about your payment activity each month when you use this card, which can help you build credit.

How can I check the status of my overcharged credit card?

To check the status of your Surge credit card order, call the issuer’s customer service department at 866-449-4514. An online status checker is not available.

How do I cancel my Surge credit card?

Call Continental Finance Customer Service at 866-449-4514 to cancel your Surge credit card. To process the cancellation, the customer service representative may ask for some personal information, such as your subscription number and your social security number.

Can I manage my new Surge card account online?

Definitely. When banking online, you can do the following with your SurgeCardInfo:

- Pay with your SurgeCardInfo

- Sign up to receive online invoices for your SurgeCardInfo

- recent transactions

- Previous Statements

- View your payment history

- View your SurgeCardInfo balance and other important information.

About CFC

Continental Finance Company (“CFC”) has been providing credit cards and services to consumers with subpar credit since its founding in 2005. The company specializes in providing consumers with credit products and services that are largely overlooked by traditional credit card issuers and local banks.

As a consumer finance company with a state-of-the-art consumer credit platform, we can offer a wide range of services to our clients if they are not accepted by other financial institutions. Since the company’s inception, CFC has prided itself on its corporate responsibility to its clients in terms of strong customer service and fair treatment programs.

CFC has a dedicated customer service team that understands the importance of helping clients manage their credit responsibly. Each of our customers will receive the best service possible, including all the tools they need to successfully manage their loan.

Conclusion

Before signing up, consider bad credit card options that can cost you less in the long run, including secured credit cards.

Surge Mastercard credit cards are available to customers with credit that is less-than-perfect, so you can start building credit habits. These cards, however, have high fees and are therefore more costly than other credit cards.